TOOLS PROVIDED

Workflow Solutions

ITG Net

ITG Net is our global, broker-neutral financial communications network that provides secure, fully supported connectivity between buy-side and sell-side firms for multi asset-class order routing and client indication-of-interest (IOIs) messages. ITG Net connects to over 600 brokers and third-party trading platforms, with compliance-driven trade surveillance reporting.

RFQ-hub

RFQ-hub is our workflow tool which allow users to submit requests for Quotes (RFQs) to one or more of their liquidity providers. The tool allows users to centralize the RFQ process and put their liquidity providers in competition to win their trade.

Algo Wheel

Algo Wheel automates and randomizes broker selection–subject to your constraints and trading goals. Algo Wheel helps buy-side clients achieve performance gains through improved execution quality and workflow efficiency by reducing or eliminating trader bias. At set intervals, performance data collected is analyzed, creating a feedback loop to support best execution.

Commission Manager

Get the agency, broker-neutral commission management tool you need: Trade with and pay 1,200+ research brokers and 3,000+ research providers and market data vendors, streamline processes to reduce operational risk, improve information security and meet regulatory/compliance obligations with full-audit reporting. Available as a commission sharing agreement (CSA) platform and/or research payment account (RPA) solution to meet MiFID II unbundling requirements.

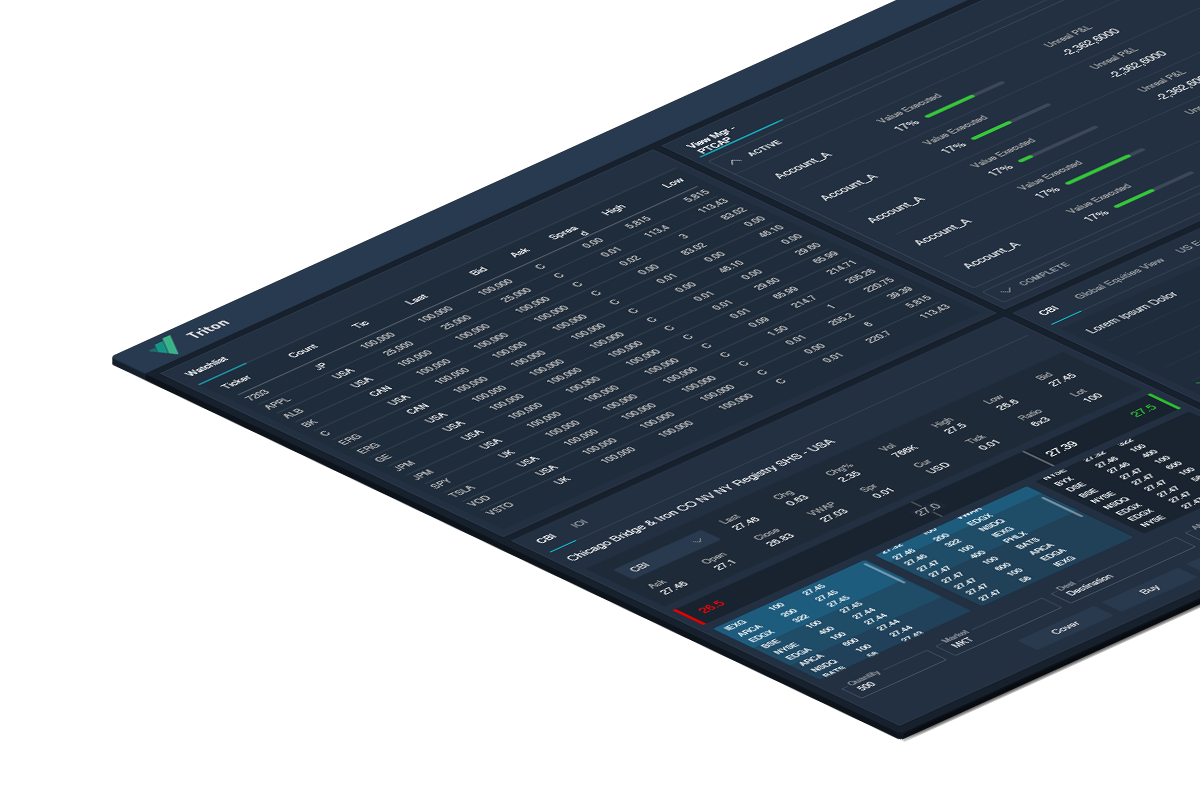

Triton EMS

Triton execution management system (EMS) is a global, broker-neutral, multi asset-class platform that combines Virtu’s cutting-edge liquidity, execution, analytics and workflow solutions into one unified and customizable execution interface.